Reviews on Credit Card Approval With High Credit Utilization

Editorial Notation: Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions. Our third-political party advertisers don't review, approve or endorse our editorial content. Information technology's accurate to the all-time of our cognition when posted.

Advertiser Disclosure

We think it's of import for y'all to understand how we brand coin. Information technology's pretty simple, actually. The offers for financial products you lot see on our platform come from companies who pay us. The money nosotros brand helps the states requite you lot access to free credit scores and reports and helps us create our other smashing tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since nosotros generally make money when you find an offer you lot like and get, we effort to prove you offers we call back are a expert friction match for you. That'southward why we provide features like your Approving Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to evidence you as many corking options as nosotros can.

Before nosotros swoop into how using your credit card may affect your credit scores, let's recap what nosotros mean when we talk well-nigh "credit card utilization."

Credit menu utilization — or just credit utilization, for brusque — refers to how much of your available credit you utilise at any given time.

Yous tin can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits. The resulting percentage is a component used past most of the credit-scoring models because it's oftentimes correlated with lending gamble.

Near experts recommend keeping your overall credit bill of fare utilization below 30%. Lower credit utilization rates suggest to creditors that you can use credit responsibly without relying too heavily on it, so a depression credit utilization rate may be correlated with higher credit scores.

Now that we've defined our terms, permit's look more than closely at how your credit utilization relates to your credit scores.

- Why does my credit carte utilization affect my credit scores?

- How does my credit carte utilization affect my credit scores?

- How tin can I lower my credit card utilization?

Why does my credit card utilization bear upon my credit scores?

Your credit utilization rate is an important indicator of lending risk. In the optics of most lenders, a person who constantly charges all the money they can — hit or going over their credit limit on a regular ground — is more probable to have difficulty repaying that money.

Conversely, someone who charges smaller amounts may be more likely to be able to pay off their balance in full each month, then they represent a lower risk to the lender.

How does my credit menu utilization affect my credit scores?

There are many different credit-scoring models, and then it's difficult to calculate exactly how credit utilization will touch your credit scores.

With that said, there's a stiff correlation betwixt a consumer's credit card utilization rate and their credit scores. Though individual cases may vary, those who go along their utilization percentage low generally have higher scores than those who habitually max out their credit cards.

If you don't desire your credit utilization to negatively affect your credit scores, consider your spending habits. Factors such as your credit history and the number of cards in your wallet matter, as well.

High utilization on a single credit bill of fare could especially hurt your credit scores if you have a brusk credit history and only one carte. On the other mitt, yous may feel the effects less if yous accept a long and excellent credit history and spread your utilization beyond multiple cards.

Though it's an of import factor in computing your credit scores, try not to focus just on this one aspect. Keep the big motion-picture show in mind.

What factors determine my credit scores?

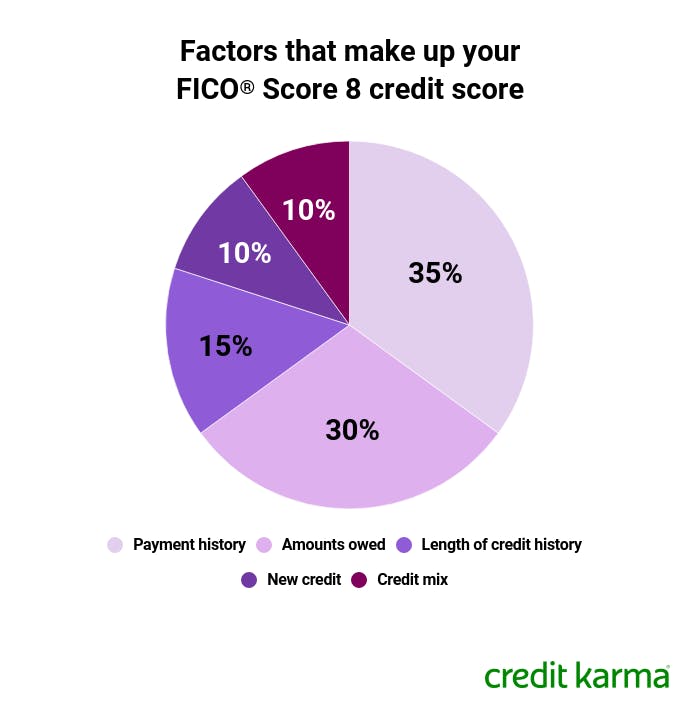

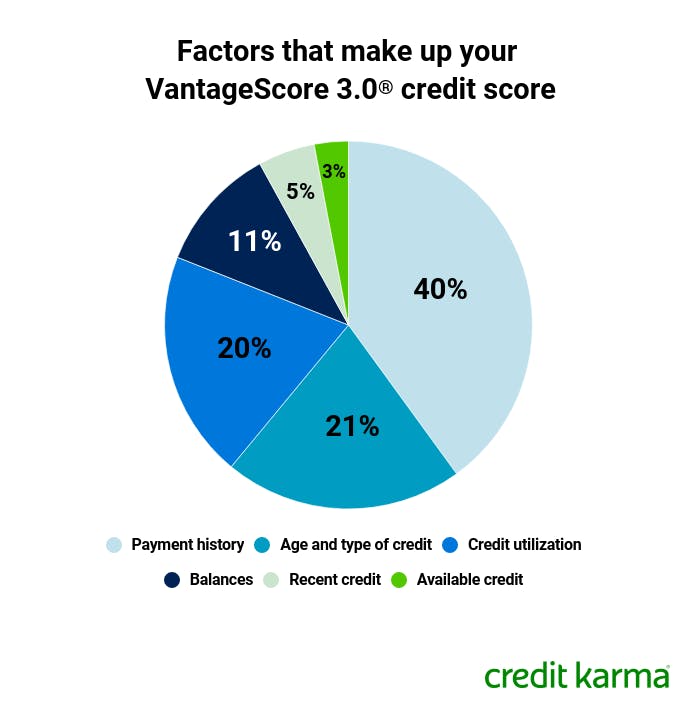

A number of credit-influencing factors are commonly used in calculating your credit scores. These include your credit carte utilization, pct of on-fourth dimension payments and the boilerplate historic period of open credit lines.

The charts below evidence what factors make up ii popular credit score models, the FICO® Score 8 credit score and VantageScore iii.0® credit score models. You'll notice that credit card usage, or utilization, is important to both, merely non the merely factor.

Prototype: ccupdateutilization-fico

Prototype: ccupdateutilization-fico  Image: ccupdateutilization-vantage

Image: ccupdateutilization-vantage How can I lower my credit bill of fare utilization?

Hither are 3 tips that may help y'all lower your credit utilization.

- Make credit card payments more in one case a calendar month. This fashion, your balance never gets besides high. Your credit card issuer will typically report your credit activity to the credit bureaus once a month. So, if you pay off a portion — or even all — of your credit carte du jour nib before that appointment, y'all can lower your credit utilization.

- Spread your charges across multiple cards each month. Using multiple cards will issue in multiple accounts of low credit utilization rather than one account with high utilization. Just keep in mind that sure credit-scoring models will look at your overall credit utilization and/or the utilization on private credit cards, so this technique may not always piece of work.

- Increase your available credit. If your income has increased, yous've maintained an amazing credit history or yous take little debt, information technology doesn't injure to inquire for a credit limit increase. Merely remember that this can sometimes result in a hard enquiry on your credit. If you don't accept first-class credit, y'all may desire to consider opening a secured credit card and adding to its security deposit over time.

Bottom line

You lot don't accept to carry a credit carte balance or pay interest every month to show credit card utilization. Even if you pay your credit bill of fare balances in full every month, simply using your card is enough to evidence activity.

While experts recommend keeping your credit carte utilization beneath xxx%, it'due south important to note that creditors likewise care nigh the total dollar corporeality of your available credit. This ways that if yous have a low credit limit, information technology'due south not necessarily a huge bargain if your credit bill of fare utilization rate is slightly college than recommended.

Source: https://www.creditkarma.com/credit-cards/i/credit-card-utilization-and-your-credit-score

0 Response to "Reviews on Credit Card Approval With High Credit Utilization"

Enregistrer un commentaire